Trips

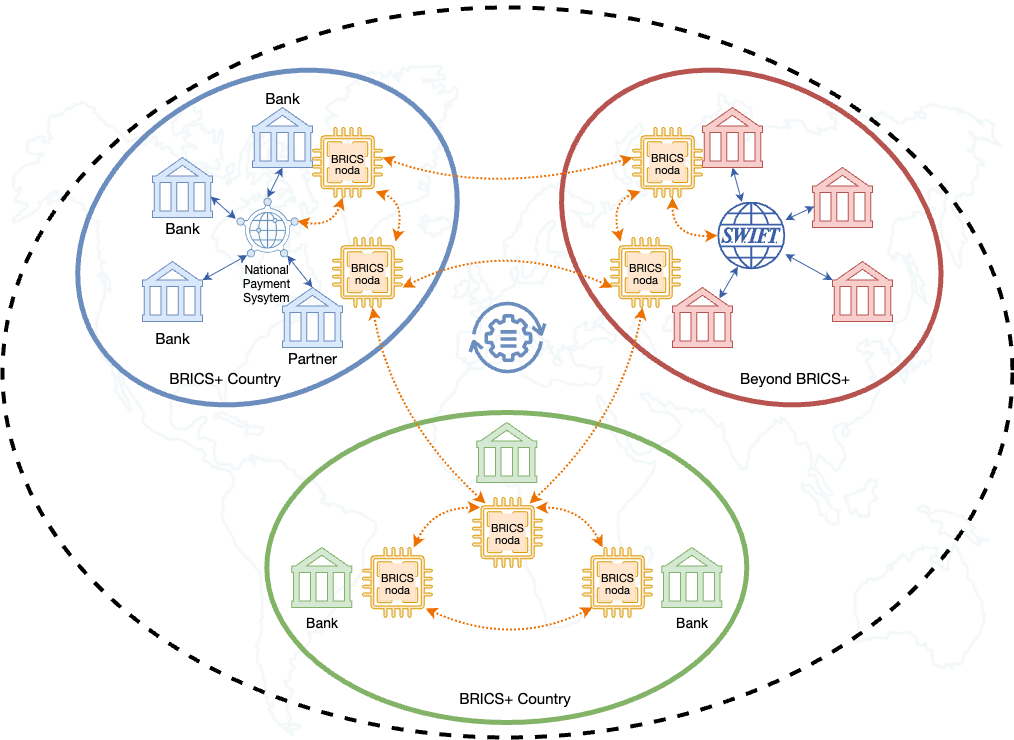

Pay like a local in BRICS+ countries using familiar instruments and smoother FX experiences. Designed for travelers, students, and professionals.

- Card and wallet acceptance through interoperable rails

- Transparent rates and clear confirmations

- Merchant experiences aligned with local standards